Quickly Personal loan Immediate encourages being familiar with the nuances of private loans, highlighting that even though making use of for the maximum quantity can deal with significant fiscal demands, it might also bring about greater repayment burdens. The company advises borrowers to cautiously Assess their repayment capabilities along with the real requirement on the financial loan dimensions, aiming to harmony rapid economical methods versus opportunity extensive-time period challenges.

Inside a predicament in which you require rapid cash but Never fit the skills for a conventional limited-phrase mortgage, a pawn shop financial loan is likely to be correct. It's Specifically handy when you are sure to obtain revenue inside the thirty-day mortgage period with which to repay the credit card debt.

Are pawnshop financial loans costly? Chevron icon It suggests an expandable portion or menu, or at times former / up coming navigation selections.

Go through in app Angle down icon An icon in The form of the angle pointing down. A pawn shop financial loan might be a good way to boost brief cash, but at the danger getting rid of your home. mj0007/Getty Leap TO Portion Chevron icon It suggests an expandable part or menu, or in some cases previous / future navigation possibilities.

An item that looks like it has sustained its quality can get you speedy cash, but for those who’re wanting to have the most income from advertising your products and solutions, we persuade you to look at these inquiries: would be the item in superior Doing work situation?

Peer-to-peer on line financial loans — Peer-to-peer on the net financial loans come from men and women traders as an alternative to financial institutions and credit score unions. You’ll really need to fill out an application, and your options may very well be limited based on your credit history (our guide to credit history score ranges will help Offer you an concept of where you stand).

When you have precise questions about the accessibility of This page, or need guidance with utilizing This website, Speak to us.

What occurs if I am unable to repay my pawnshop personal loan? Chevron icon It suggests an expandable area or menu, or often past / future navigation possibilities.

Payday loans and cash improvements: Payday financial loans and cash developments are short-expression loans through which you give a Examine to the lender for the amount you'll want to borrow, as well as their fees. The lender provides you with cash, and it's essential to repay the full volume within a small time, for instance two months.

Pawn shop financial loans can be a beautiful solution if your credit history is tough so you’re not able to take out a standard personal loan.

Or, if unable to pay out back again the total bank loan, you would have to pay $forty before thirty days are up or even the pawn shop will be cost-free to market your item.

Cash-progress applications: Cash-advance apps like EarnIn and Dave can offer an progress read more in your paycheck a couple of days early. Try to look for an application that expenses negligible charges or curiosity.

Lenders use your social protection number to verify your identification. It is significant which you enter your legitimate social stability quantity. Lenders will reject applicants whose facts they cannot verify. Social Safety Range

Might bring about repeat borrowing: About 15% of pawn loans are never ever repaid, in accordance with the Countrywide Pawnbrokers Affiliation, and repeat prospects are popular.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Brandy Then & Now!

Brandy Then & Now! Julia Stiles Then & Now!

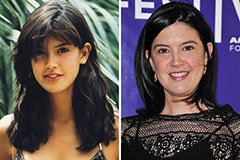

Julia Stiles Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!